How to Register and Activate UAN Online for EPF Step-by-Step Guide

by onleaves

The Universal Account Number (UAN) serves as a distinctive identifier assigned to every member of the Employees’ Provident Fund Organization (EPFO) and is issued by the Ministry of Labour and Employment. Throughout an individual’s service period, they are assigned a single UAN EPF, acting as the nexus for all linked EPF accounts. However, unlocking the array of services associated with the activation and registration is imperative. This process can be conveniently executed online through the UAN Member Portal.

Amidst job transitions, an employee’s EPF account number and member ID may undergo changes, but they remain constant. In cases where two are inadvertently allocated, it becomes crucial for the member to promptly notify both their current employer and the EPFO. This ensures the deactivation of the obsolete and facilitates the seamless transfer of the preceding EPF corpus to the new PF account. This proactive approach safeguards the continuity and integrity of the individual’s provident fund holdings.

Generating UAN for EPF: A Step-by-Step Guide for Employers

When an employee enters the service sector for the first time, the onus is on the employer to generate the Universal Account Number for them, especially if the company has a workforce of 20 or more employees. If the employee already possesses a UAN from a previous organization, providing those details to the new employer is essential. Here’s a systematic guide for employers to generate a new for an employee:

EPF Employer Portal Login:

- Access the EPF Employer Portal using the Establishment ID and password.

Register Individual:

- Navigate to the “Member” section and click on the “Register Individual” tab.

Enter Employee Details:

- Input the employee’s particulars, including PAN, Aadhaar, bank details, etc.

Approval Process:

- Proceed to the “Approval” section and review and approve all submitted details.

UAN Generation:

- Once the approval is complete, the EPFO generates a new one for the employee.

Linking PF Account:

- The employer can then seamlessly link the employee’s PF account with the newly generated UAN.

Following these steps ensures a smooth generation process, facilitating the integration of the employee into the EPF system while maintaining compliance with regulatory requirements.

Discovering Your UAN: A Quick Guide

Once your Universal Account Number (UAN) is generated and linked to your EPF account, employers typically provide this information to the employees. Nevertheless, if you wish to independently access your, follow these straightforward steps:

Visit EPFO Member Portal:

- Head to the EPFO Member Portal for UAN-related services.

Select “Know Your UAN”:

- Locate and click on the “Know your UAN” option.

Provide Details:

- Input your registered mobile number and captcha code, then click “Request OTP.”

OTP Verification:

- Enter the OTP received, along with the provided captcha, for verification.

Enter Additional Information:

- Input your Name, Date of Birth (DOB), Aadhaar/PAN/Member ID, and captcha for further verification.

Retrieve UAN:

- Click on “Show me” to instantly retrieve and know your UAN.

This streamlined process empowers you to access your independently, enhancing your control and awareness of your EPF details.

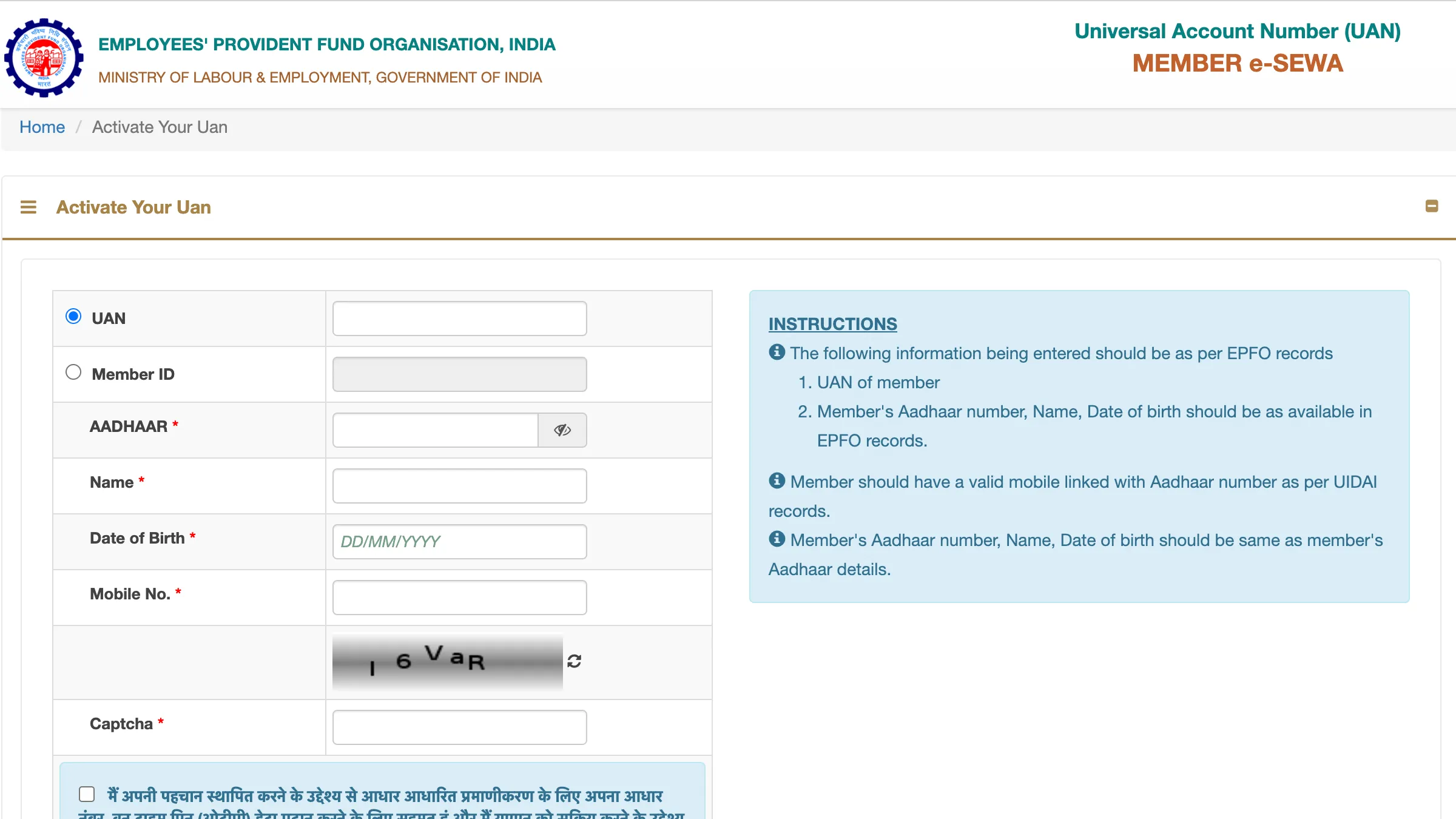

Activating UAN Through the EPFO Portal: A Step-by-Step Guide

Before you can access any online services related to the Employees’ Provident Fund (EPF) on the EPFO portal, it’s essential to register and activate your Universal Account Number (UAN). Without proper activation, access to any online facilities provided by the EPFO is restricted. To initiate activation and registration, follow the steps outlined below:

Visit EPFO Member Portal:

- Go to the EPFO Member Portal and locate the “Activate UAN” option.

Enter Details:

- Input your UAN/Member ID, along with your Aadhaar number, name, date of birth (DOB), mobile number, and captcha code. Click on “Get Authorization PIN.”

Authorization PIN:

- An authorization PIN will be sent to the mobile number registered with EPFO.

Verify and Activate:

- Enter the received PIN and click on “Validate OTP and Activate UAN.”

Activation Confirmation:

- Once successfully verified, you will be activated, and a password will be sent to your registered mobile number.

Login Credentials:

- With the activated \and the provided password, you can now log in to your EPF account and access the online services seamlessly.

This systematic approach ensures the successful activation of your, unlocking the full spectrum of online services offered by the EPFO for managing your Provident Fund account.

Also Read: Unlocking the Process of Settling ICICI Credit Card EMI through Foreclosure

Connecting Aadhaar with UAN: A User-Friendly Guide

After accessing your Employees’ Provident Fund (EPF) account, it becomes crucial to link your Unique Account Number (UAN) with Aadhaar for seamless authentication. Follow these straightforward steps to efficiently link your with Aadhaar:

EPF Account Login:

- Initiate the process by logging in to your EPF account through the EPFO member home page.

Navigate to the KYC Section:

- In the “Manage” section, locate and click on the “KYC” option.

Aadhaar Details Entry:

- Select the square corresponding to the Aadhaar and input your 12-digit Aadhaar number along with your name.

Save Your Details:

- Click on the “Save” option to submit your Aadhaar details for verification.

Check KYC Status:

- Monitor the status of your request in the “KYC Pending for Approval” section.

Verification Process:

- Once the Unique Identification Authority of India (UIDAI) confirms your details, your current employer’s name will be displayed under “Approved by Establishment,” and “Verified by UIDAI” will be indicated next to your Aadhaar.

This systematic procedure ensures a successful link between you and Aadhaar, facilitating a secure and verified association for EPF-related transactions. Stay informed and effortlessly manage your EPF details through this user-friendly guide.

Also Read: Discover the Digital Dreidel Experience with a Google ‘Play Dreidel’ Search

Essential Documents for UAN Activation

When activating your Universal Account Number (UAN), certain crucial documents are necessary, typically collected by your employer during your onboarding process. Ensure you have the following documents readily available for activation:

Aadhaar Card:

- Provide a copy of your Aadhaar card, a vital identity document with your unique 12-digit Aadhaar number.

PAN Card:

- Furnish your PAN card, which serves as a crucial identification document for financial transactions.

Bank Account Details and IFSC:

- Submit your bank account details, including the account number and the Indian Financial System Code (IFSC), facilitating seamless fund transactions.

Additional Proof, if Required:

- Be prepared to provide any other proof of identity or address, if requested. This may include documents such as a driver’s license or utility bills.

Ensuring the availability of these documents during the activation process is essential for a smooth and efficient onboarding experience. These documents play a vital role in verifying your identity and are integral to the activation of your various Employees’ Provident Fund (EPF) services.

Why Having a Universal Account Number (UAN) Matters

Think of the AN as a convenient umbrella that brings together all your PF accounts in one place. In the past, keeping tabs on your Employee Provident Fund (EPF) accounts used to be a bit of a challenge, but thanks to the, it’s now a breeze.

Here’s why it’s so handy:

Easy PF Transfer:

- With this, moving your PF from old accounts to new ones is a simple online process. No more hassle of dealing with paperwork or complex procedures.

Seamless Access to Online Services:

- Activate your, and voilà! You unlock the door to a range of online services offered by the EPFO. Manage your PF accounts and access various services with just a few clicks.

Having your UAN is like having a personalized key to a host of employee-specific benefits. It streamlines your EPF experience, making it more accessible and user-friendly.

How UAN Makes Life Easier for Employees

The Universal Account Number comes packed with perks for employees. Check out some of the cool benefits it brings your way:

One-stop EPF Tracking:

- No more juggling multiple accounts. Acts as your EPF hub, making it a breeze to keep tabs on all your accounts in one place.

Online EPF Passbook Viewing:

- Say goodbye to the old-fashioned way. With UAN, you can view your EPF passbook online, giving you a quick and convenient way to monitor your fund transactions.

Online Partial PF Withdrawal:

- Need some funds for a specific purpose? lets you claim partial PF withdrawal online, saving you time and effort.

Online EPF Account Transfer:

- Moving jobs? No worries! enables you to transfer your EPF accounts seamlessly online, eliminating the hassle of paperwork and delays.

Check EPFO Claim Status Online:

Wondering about the status of your EPFO claim? lets you check it online through the EPF member portal, providing you with real-time updates.

UAN isn’t just a number; it’s your ticket to a more streamlined and accessible EPF experience. Enjoy the perks!

Frequently Asked Questions (FAQs)

Q: Can I activate UAN using offline methods?

A: Nope, activation is exclusively an online affair. The registration is specifically for accessing EPFO’s online services, so activation happens through online channels only.

Q: Can contractual employees register their UAN and use online facilities?

A: Absolutely! Whether you’re a full-time or contractual employee in an organization with 20 or more employees, you can register and enjoy facilities online after activation, provided your salary is ₹15,000 or above.

Q: I haven’t linked Aadhaar with UAN. Can I still transfer funds online?

A: Nope, you gotta link them up. Without the Aadhaar bond, you won’t be able to transfer funds or claim PF withdrawal online. It’s a mandatory step to link your Aadhaar with UAN.

Q: I switched jobs. Do I need to activate my UAN again?

A: Nope, just a one-time activation. No need to redo it every time you change jobs. Your remains active and valid throughout your career.

Q: Is there any fee for UAN registration?

A: Nope, it’s on the house! registration comes free of charge. No need to break the bank; activating your won’t cost you a penny.

Q: Can I activate UAN through SMS or a mobile app?

A: Not at the moment. To activate your, it’s either the EPF member portal/UAN activation portal online or through the Umang app. No SMS magic for now!

The Universal Account Number (UAN) serves as a distinctive identifier assigned to every member of the Employees’ Provident Fund Organization (EPFO) and is issued by the Ministry of Labour and Employment. Throughout an individual’s service period, they are assigned a single UAN EPF, acting as the nexus for all linked EPF accounts. However, unlocking the…

Recent Posts

- Is Bhoothakaalam the Perfect Movie for Your Next OTT Binge-Watch Session?

- Financial Success with Nivesh Mitra: Your Trusted Investment Companion

- Manav Sampada Portal at ehrms.upsdc.gov.in for Viewing the E-Service Book

- School Insights Navigate Shala Darpan with Staff Login @ rajshaladarpan.nic.in

- Maharashtra Employment 2023: Register Online for Job Opportunities